Until the second quarter of 2022…

That’s how long Gartner analysts predict the current semiconductor shortage will last.

Taiwanese PC and laptop maker Acer’s Co-Chief Operating Officer Tiffany Huang predicted the same in an interview with Guardian Australia.

Meanwhile, CNBC reports, “Glenn O’Donnell, a vice president research director at advisory firm Forrester, believes the shortage could last until 2023.”

Intel CEO Pat Gelsinger is even less optimistic. Speaking at a trade show, he recently noted the chip shortage could last a “couple of years,” according to Yahoo Finance.

The truth surely lies somewhere in the middle. But whatever the exact time frame is, right now — because of the shortage — there’s a lot of opportunity ahead for investors to grab stakes in the chipmakers with a lot of upside.

I want to share one of those with you today.

The Lead Company in PC Processors Isn’t the One You Think It Is

Back in the 1990s and 2000s, if you were buying a laptop or PC — and you had the money — you had to have one with the newest Intel Corp. (NASDAQ: INTC) Pentium processor… especially if you were using a digital platform for a professional enterprise.

Intel wasn’t the only chipmaker around back then, but it was by far the most popular, best marketed, and highest grossing one — at least here in the United States.

It’s a big reason why the stock rose from $1.10 in January 1990 to $73.93 in August 2000, an increase of 6,618%.

Intel rode the coattails of this sentiment for the better part of the next two decades. However, its stock never really found its footing again for another major move, and today, there are much better-positioned investments in the semiconductor, CPU, and GPU market — mainly because these other companies offer more desirable products.

The Worm Has Turned for AMD

Advanced Micro Devices Inc. (NASDAQ: AMD) was one of those companies back during the original tech boom that was often viewed as a bargain-bin processor maker. Its processors were functional but not as high-quality as the Intel Pentium line, which is why many consumers opted for the latter.

All that is changing right before our very eyes. Intel’s dominance in the consumer PC market and elsewhere is over.

A major reason why is because of AMD’s new lineup of premium processors — in direct competition to Intel.

Last year, right before the pandemic, AMD introduced its new Ryzen line of processors.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Much to the delight of budget-minded personal PC users and gamers, AMD’s new Ryzen processor line proved faster and more powerful than Intel’s latest chips.

Presenting virtually at the Computex 2021 trade show, AMD CEO Dr. Lisa Su unveiled the company’s new desktop Ryzen 5000 series of accelerated processing units (APUs) with integrated graphics, its new discrete Radeon RX 6000M series mobile GPUs that promise unrivaled gaming performance, and its hotly anticipated Fidelity FX Super Resolution graphics upscaling technology.

These advances are going to be major drivers for the stock price over the coming years.

AMD Looking Forward

The simple fact is that computer microchips and semiconductors are everywhere from our refrigerators to our cars. As demand for these processors grows exponentially, the path to huge gains down the road feels almost certain.

AMD’s push into GPUs is another aspect of its business that makes me believe this stock is far below what it will be valued at in a few years. The creation of advanced GPUs is what will advance the development of things like next-level artificial intelligence (AI), virtual and augmented reality (VR and AR), driverless cars, and many other futuristic systems. The companies that produce quality chips that can handle the demands of these industries means big opportunities for investors, and Nvidia can’t supply everyone.

In fact, just this week, AMD unveiled two new partnerships that set the tech world abuzz. AMD will now supply its Ryzen processors and Radeon GPUs for use in Tesla’s Model S and X infotainment systems.

In similarly important news, AMD has also announced its RDNA 2 graphics architecture will be used in the next flagship Samsung Exynos system for use in its next-gen mobile devices.

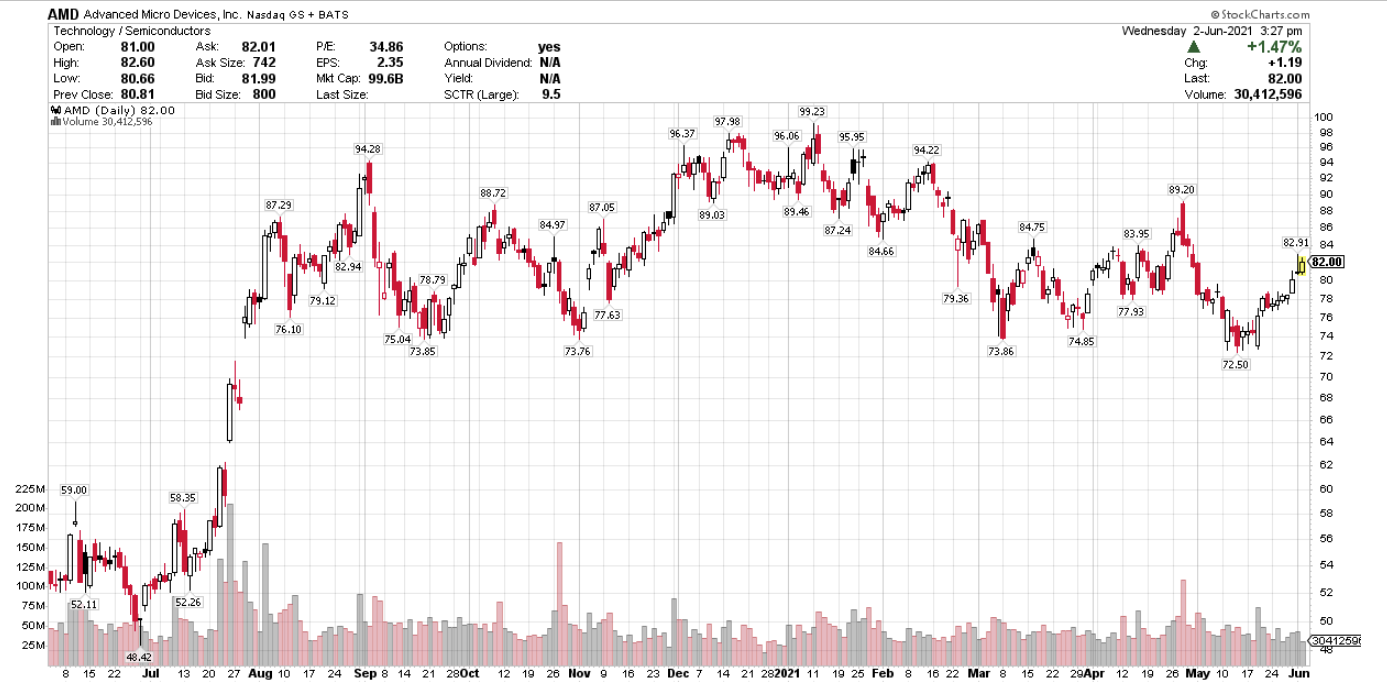

What’s even better is that while all these factors add up to the potential for great gains in the coming months, AMD is currently under pressure and offering us shares at a discount.

The stock is currently trading about 17% off its recent high of $92.23 set back in January, but I suspect it won’t fall below its recent support level at roughly $72.

Buy the dip anywhere between $72 and $80, and hold onto your butts. This stock is about to take off.

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter